The 5 Best Finance Apps 2021

Let’s face it, keeping on top of your finances can be stressful.

But luckily, there are companies and developers out there that build apps to help you manage your financial life, and perhaps even get you excited about budgets, credit scores and index funds!

Over the years, I’ve tried out a number of apps, and I wanted to share with you my top 5 finance apps for 2021.

1. Monzo

I first downloaded Monzo in April 2016 (called Mondo back then) as a beta user. At that time, it wasn’t officially a bank, it was a loadable debit card. However even in it’s infancy, it was a game-changer, because when you used the card in a shop, or online, you would get an instant notification of your expenditure, and you could categorise it in the app, to help you keep track of your finances. When you compared this to many of the mainstream banks, like Barclays, they would take hours for details of your transaction to show up in your app.

Fast-forward 5 years, and they’ve brought you a tonne of tools to help their users take control of their finances.

For example the Salary Sorter let’s you automatically sort your salary payment into various savings pots, helping you save more with less effort!

There’s shared tabs and split the bill features to make buying things with friends less awkward and fairer. There’s round up the pennies, easy access savings accounts, overdrafts… I could go on!

I believe it is Monzo’s relentless output of these novel tools that has made the bank such a success, and it is why I love this app.

P.S. If you’re interested to learn more about how I use Monzo check out my YouTube videos where I dive into the detail and blog posts that go into the detail!

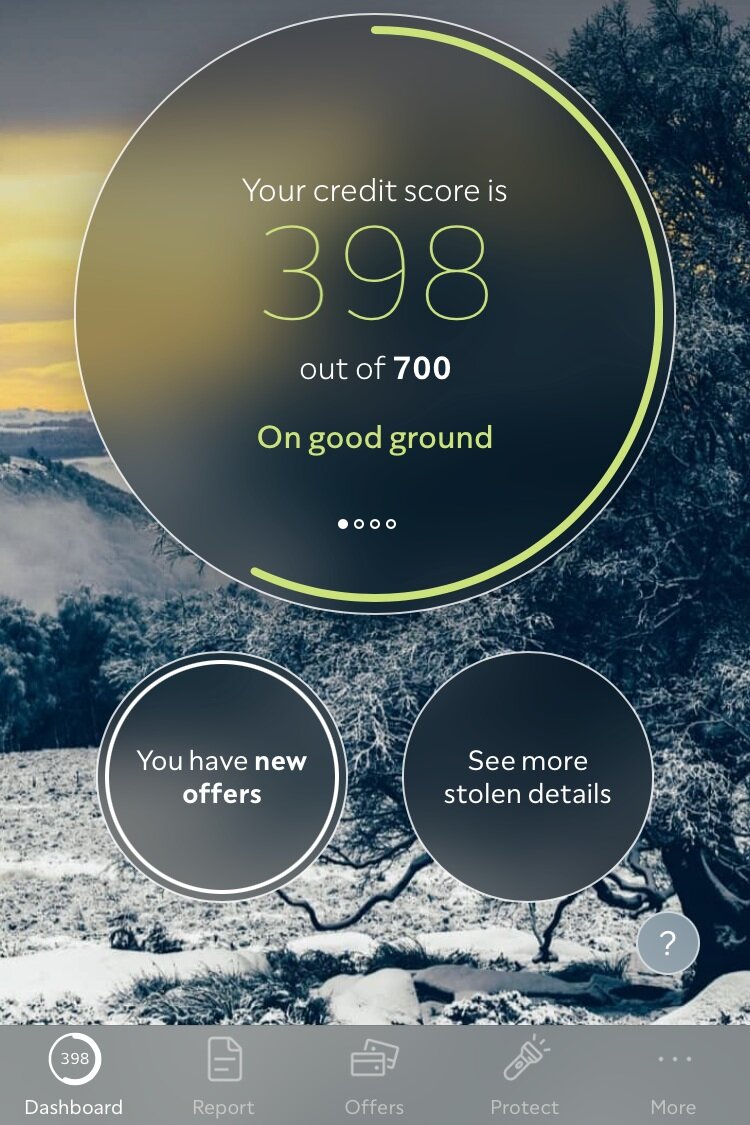

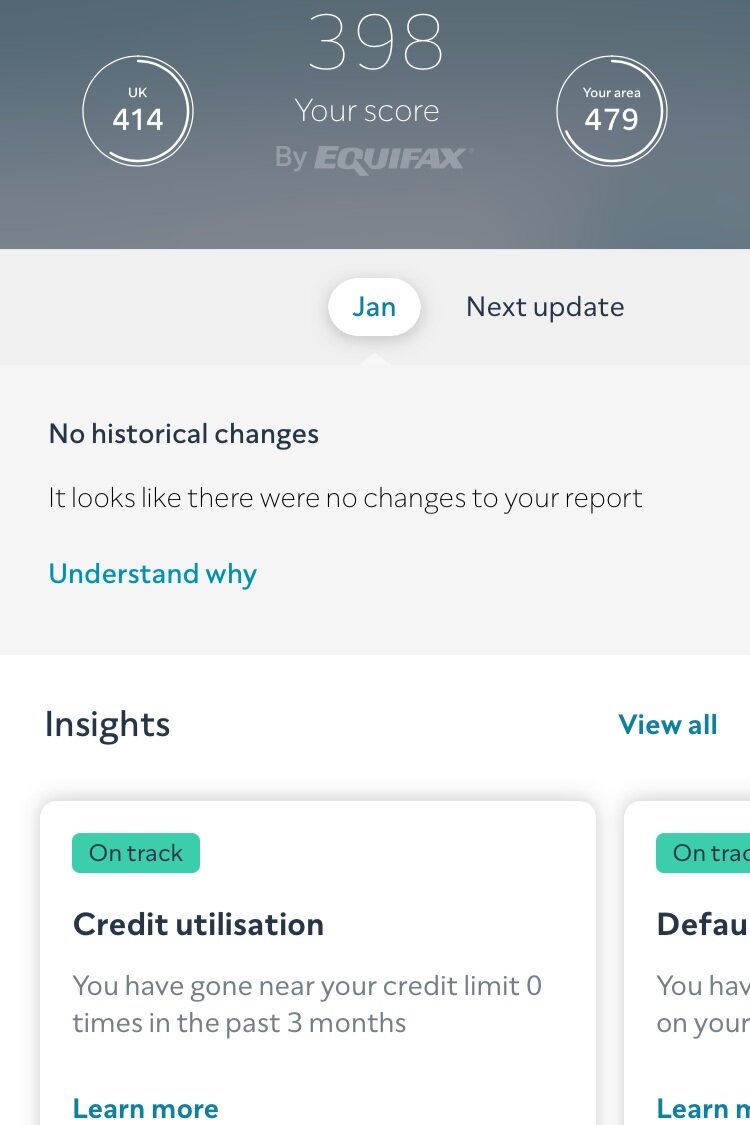

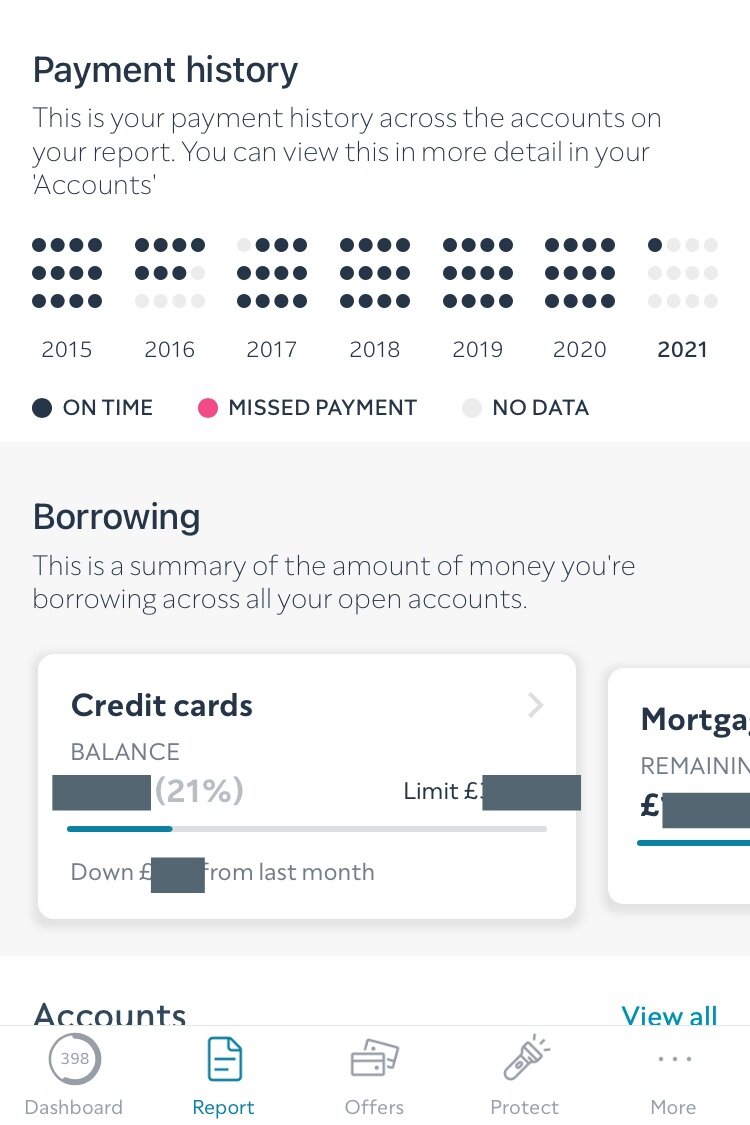

2. ClearScore

ClearScore is an app that lets you track and analyse your Credit Score. Building a good credit score is very important, especially if you plan to one day get a mortgage for a home, or perhaps get a bank loan for a car or a business.

What is great about the ClearScore app is that is presents everything in a visually appealing way. Giving you clear insight into what is driving your credit score, both positively and negatively.

The only downside to this app is that they monetise it by having an "offers" tab. I say downside because I personally don't want to see offers. 99.9% of the time, I'm not interested in new credit cards, insurance or utilities. However, some would say this isn't a drawback because you do get offers, tailored to your personal financial situation!

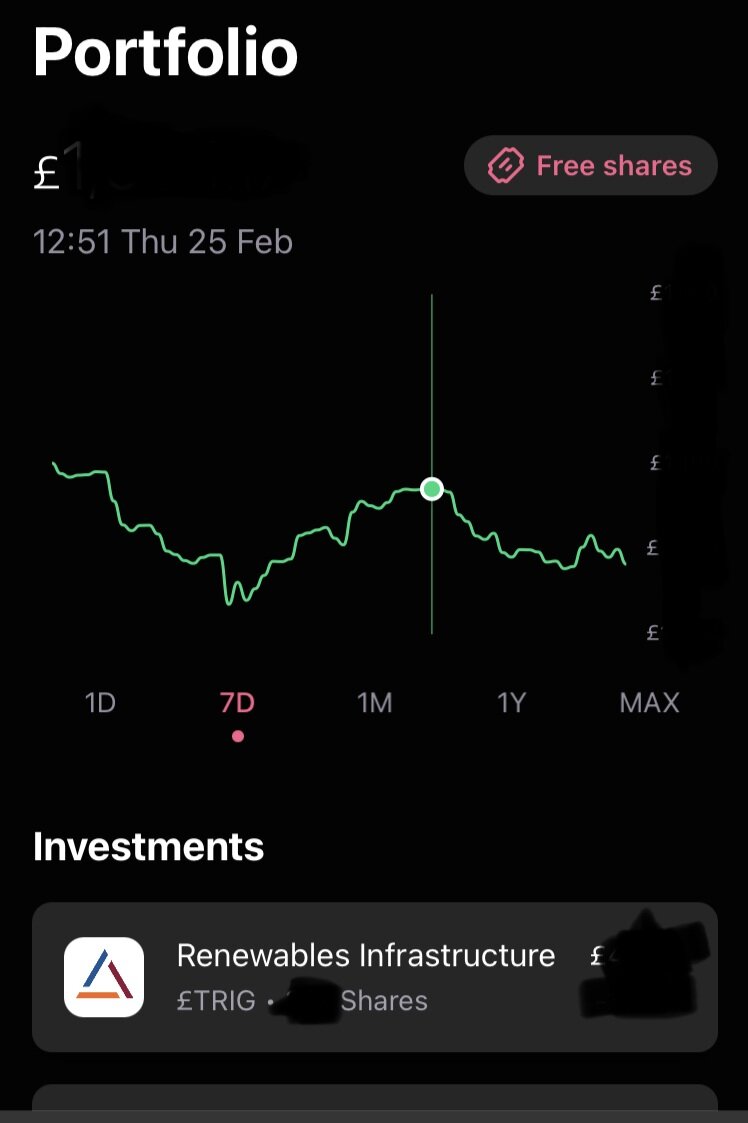

3. FreeTrade

FreeTrade is a commission-free investing app, enabling you to invest in hundreds of stocks across the UK and US.

Like Monzo is for banking, FreeTrade is an app challenging the status quo and modernising investing. I remember when I was in high school studying Economics, I wanted to get into investing in the stock market, but it was really unclear. When I eventually learnt about stock brokers, the high cost of fees and commission was enough to put me off.

With FreeTrade, you can pick up your phone and invest in your favourite companies with a few taps, for no commission!

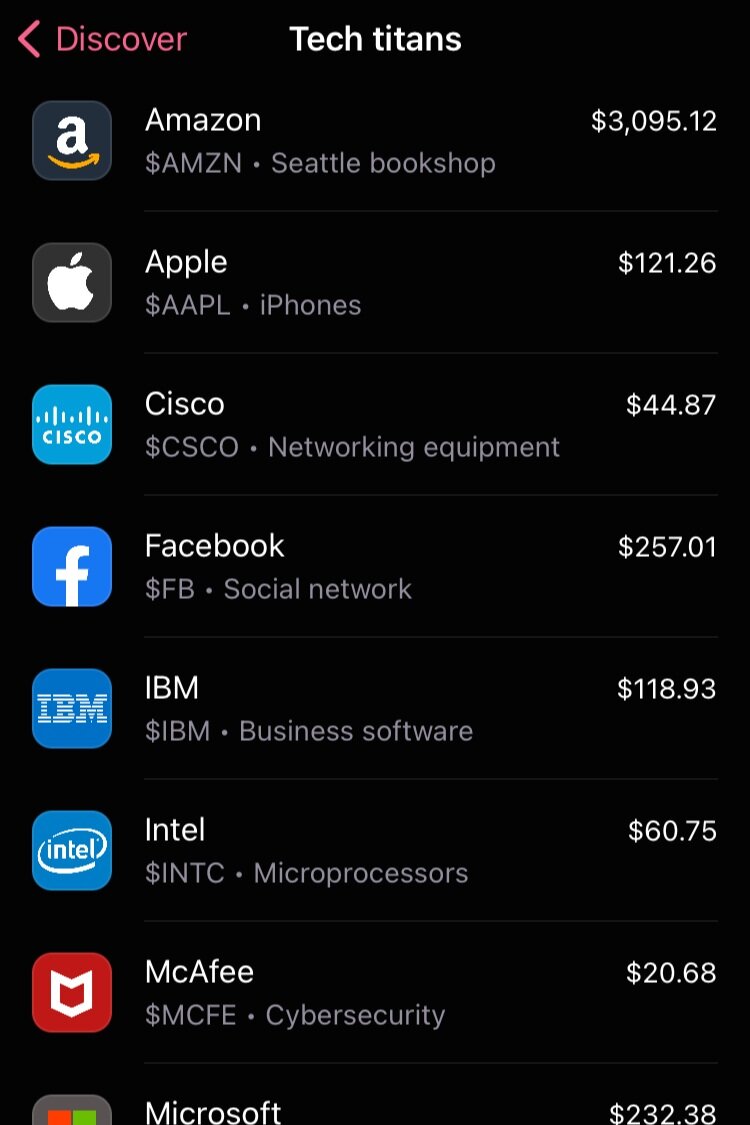

Not only can you invest at 0% commission, but you can also buy fractional shares. This means that if you wanted to buy a share of Amazon ($AMZN), that would set you back approx. $3,000 at the time of writing, just for 1 share.

With fractional shares, you can simply say you want to buy $30, and you will then own 0.01 of a share. So you no longer have to be rich to own these mega expensive stocks!

The app is still fairly young, and definitely leaves something to be desired with the quality of the charts and analysis. It pales in comparison to the amount of information and graphics you can get from something like Yahoo Finance, but I hope as they grow, these extra polishes will come with time.

4. TransferWise

TransferWise is an app and website that enables you to easily transfer money across currencies, in a transparent and very cheap way.

I first used TransferWise a couple of years ago to transfer USD currency into GBP. This is because at the company I work for, we have an employee stock purchase scheme allowing us to invest in the company. Since the shares are in dollars, I need to transfer them into my local currency which is British Pounds.

In my first year at the company, I sold shares directly from the broker in Dollars, and wired them to my British current account. This turned out to be a mistake because I was hit with less than favourable exchange rates and foreign exchange transfer fees.

I later discovered through colleagues TransferWise, and it turned out to be really simple and much more price efficient. All I had to do was setup both a USD and GBP account with TransferWise, and then I could perform the currency conversion, and bank account transfer for very low fees compared to typical high street banks. Don't take my word for it, check out this screenshot I took from their website where they compare the prices to mainstream banks:

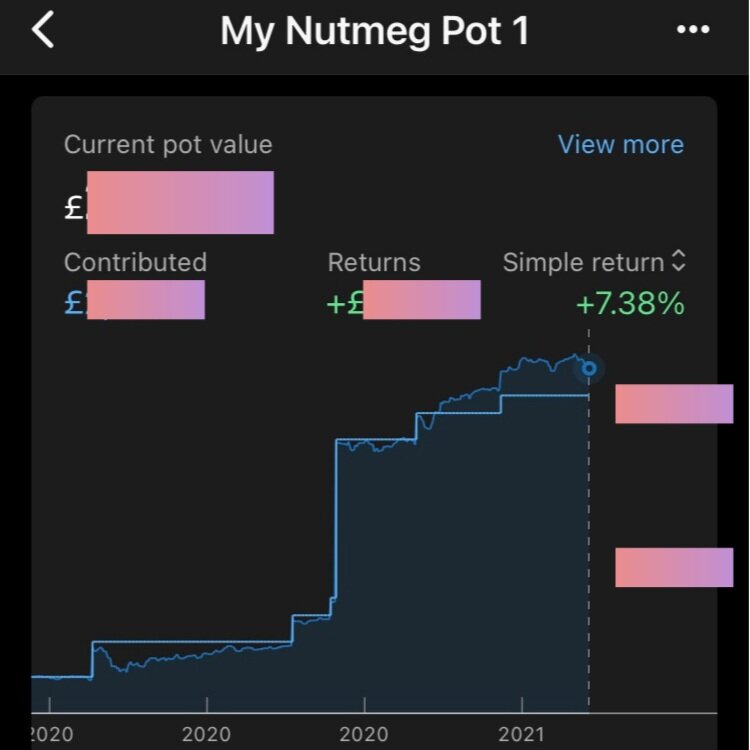

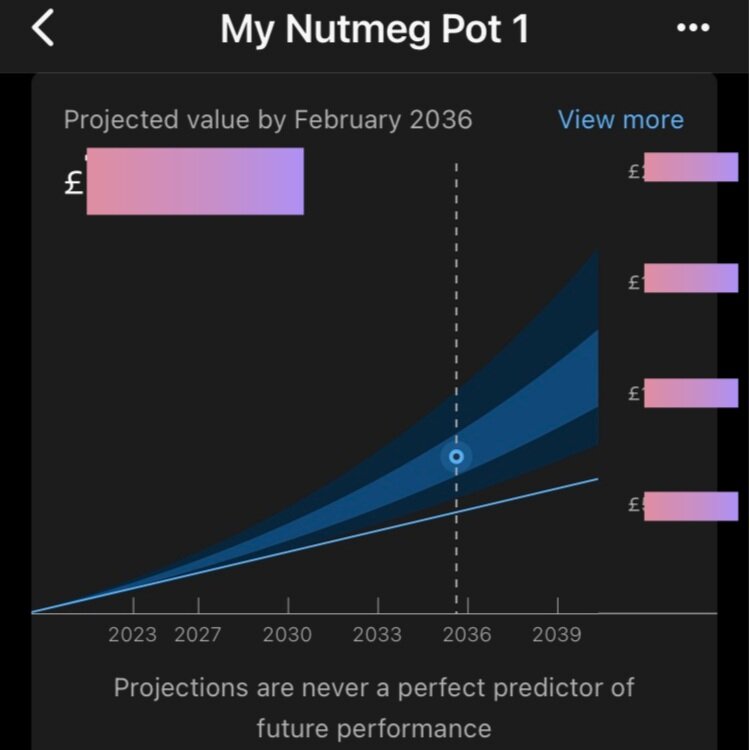

5. Nutmeg

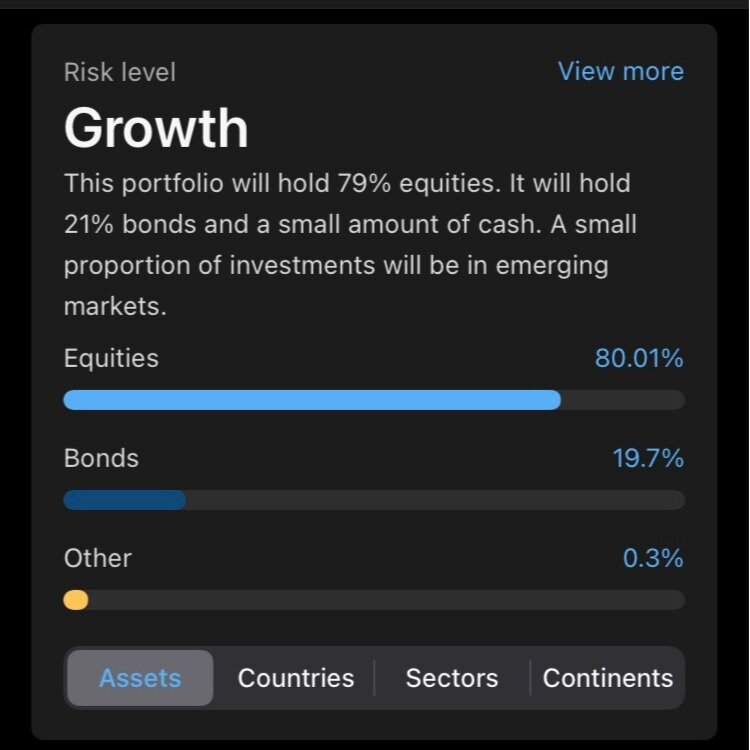

Nutmeg is an online investment management service. It enables you to invest money in a diversified portfolio of investments, according to your risk tolerance, at very cheap fees.

They have a handful of investment strategies, but in my opinion they boil down to 3 approaches:

Fully Managed - Higher fees, invest in a diversified portfolio, but with the fund managers strategically picking stocks they think will outperform others.

Socially Responsible - Medium fees, invest in a diversified portfolio, but with the investments focused on environmental, social and governance factors. Typically this means companies in industries like tobacco, oil & gas etc. are avoided.

Fixed Allocation - Low cost, diversified portfolios with automated rebalancing.

I personally invest with the Fixed Allocation strategy (otherwise known as passive fund management) for 2 reasons.

Firstly, they have the lowest fees.

Secondly, there is a lot of research out there that compares Active Management Vs. Passive Management and demonstrates that on average Active Management doesn't outperform Passive Management, despite charging higher fees.

I think of Nutmeg as my long term saving strategy. With each monthly pay check I will set aside a portion of it to pay straight into Nutmeg, so I don't think about it. I just write that money off before I can spend it!

In fact, I further automate this by using Monzo's Salary Sorter to set aside £XXX straight into an "Investment" pot. If you want to learn more about how you can achieve this, check out my blog / video called My Tips for Saving with Monzo.

The standout feature of Nutmeg compared to other larger, mainstream asset managers such as Vanguard, Fidelity and so on, is that their mobile app has a really clean, simple design. It's a pleasure to quickly view every week or so to check in on your returns or your investment allocations.

Follow Me!

Before you go any further, if you’re enjoying my content, please consider subscribing to both my Newsletter, and my YouTube channel for more!

How to split finances with your partner. I share my thoughts on some common approaches to splitting finances with your partner, and what I view as pros and cons to these methods. I also share what I currently do.